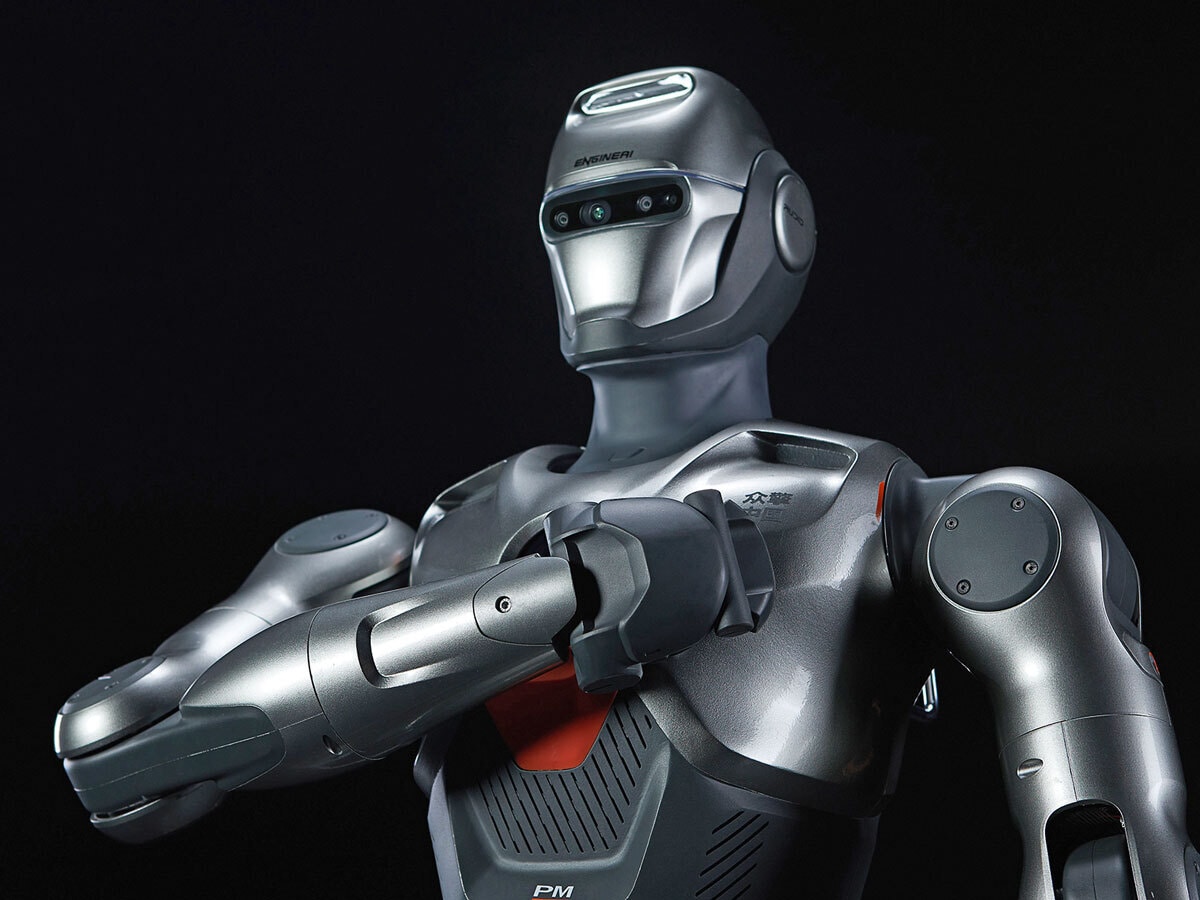

Robots: A $7trn Opportunity?

Citigroup recently projected the robot market will reach $7trn by 2050, by which time there could be 648 million humanoid bots in the world. China is poised to take a significant share of that market, Bloomberg has detailed. Start-ups like EngineAI (pictured) and Unitree have showcased bots in events like robot marathons and kickboxing; others are being tested in roles from healthcare to policing and even combat.

Dollar/Bond Link Breaks Down

The traditional link between US bond yields and the dollar has weakened as investors pull back from US assets amid policy uncertainty. Since US President Donald Trump’s tariff announcement in early April, 10-year yields rose to 4.42% while the dollar fell 4.7%, the Financial Times outlined. This divergence, rare for the US, mirrors patterns seen more often in emerging markets, and raises questions around the greenback’s institutional credibility.

Samsung’s AI Challenge to Google

The South Korean giant [SSNLF] is close to a major deal with Perplexity AI, aiming to preload its app on future devices and embed its search tech into Samsung’s browser and Bixby assistant. The integration could debut with the Galaxy S26 in 2026, Bloomberg reported, signaling a deeper bet on artificial intelligence-driven (AI) search to rival Alphabet’s [GOOGL] Google and Microsoft [MSFT].

GE Vernova Surged 27.55% Last Month

May was Wall Street’s best month since November 2023, with the Industrial Select Sector SPDR Fund [XLI] up nearly 9%, outpacing the broader market’s 6% gain. GE Vernova [GEV] led the pack with a 27.55% monthly surge. Seeking Alpha analyst Michael Del Monte is bullish on the stock, citing long growth runway and margin expansion, among other factors. For more, read OPTO’s recent deep dive into GEV stock.

Anglo American Spinoff Makes London Debut

Valterra [ANGPY], formerly known as Anglo American Platinum, listed on the London Stock Exchange on Monday. The $11bn platinum company is the world’s most valuable producer of platinum, the price of which has risen due to demand from catalytic converter manufacturing. The spinoff marks a key step in Anglo American’s [NGLOY] overhaul following last year’s £39bn hostile takeover bid from rival BHP [BHP].

Sanofi Strikes Deal for Blueprint Medicines

The French pharmaceuticals company [SNY] has agreed to purchase US-based Blueprint Medicines [BMPC] in order to boost its rare immunology diseases portfolio. The $9.5bn agreement is the biggest deal made by a European healthcare company so far in 2025 and gives Sanofi access to the drug Ayvakit. Blueprint shares jumped 27% on the news, though Sanofi stock dropped 1%.

Planet Labs Earnings Preview

In April, Goldman Sachs analyst Noah Poponak downgraded Planets Labs [PL] from ‘buy’ to ‘neutral’, citing persistent losses and macro risks stemming from a potential recession. Was this premature? Ahead of the firm’s earnings report tomorrow, OPTO unpacks the bull and bear cases for PL stock, and asks if a global boost in defense spending could help the firm turn a profit.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy